The global asset management industry is on the brink of a once-in-a-generation shift in competitive dynamics due to five converging trends: digital, diminishing investment returns, heightened regulation, a shake-up in active management, and increased demand for alternative assets. To succeed in a reshaped landscape with intense pressure on growth and margins, asset managers need to improve operational efficiency and reallocate resources to high growth areas of the business.

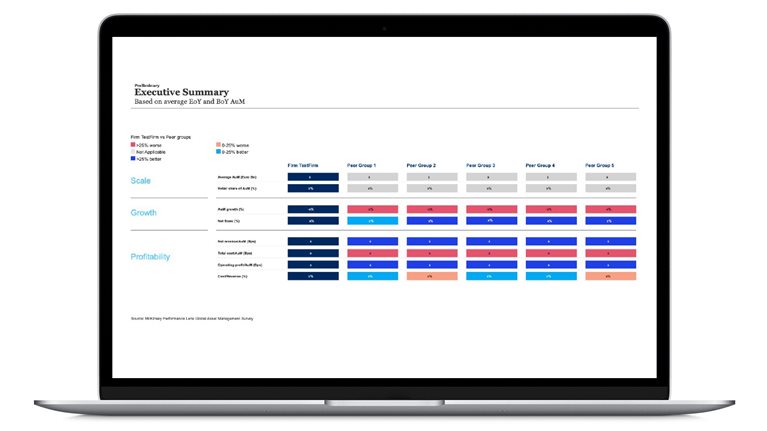

The Global Asset Management Survey gathers granular economic data from hundreds of firms around the world and benchmarks operational effectiveness across multiple dimensions. By comparing performance on growth (AUM and flows), profitability, and productivity, executives can identify and prioritize strategic moves to improve business performance.